Understanding the Pulse of the US Economy: Consumer Prices and Inflation Trends

Table of Contents

- Self-Storage Almanac 2024 :: Preview Issue

- Data Indeks Keyakinan Konsumen Indonesia pada April 2024 - Dataindonesia.id

- 13th November 2024 (Daily GK Update)

- Top Global Consumer Trends 2024!

- 2024 Consumer Trends: Navigating Uncertainty - PaperplaneCo

- Floral Trend Report 2024 - part 2 | Marginpar

- Consumer Price Index 2024 Malaysia Release Date - Hazel Clarice

- 2024 Global Consumer Trends Price

- Consumer Trends Report 2024: consumenten blijven voorzichtig, ondanks ...

- Consumer Price Index: Rising Inflationary Pressures in Indonesia as ...

Introduction to Consumer Prices and Inflation

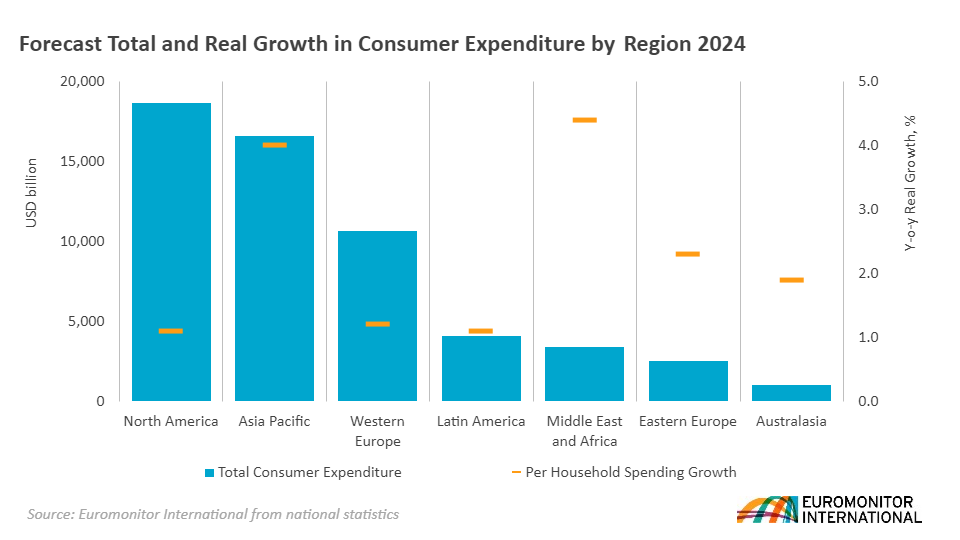

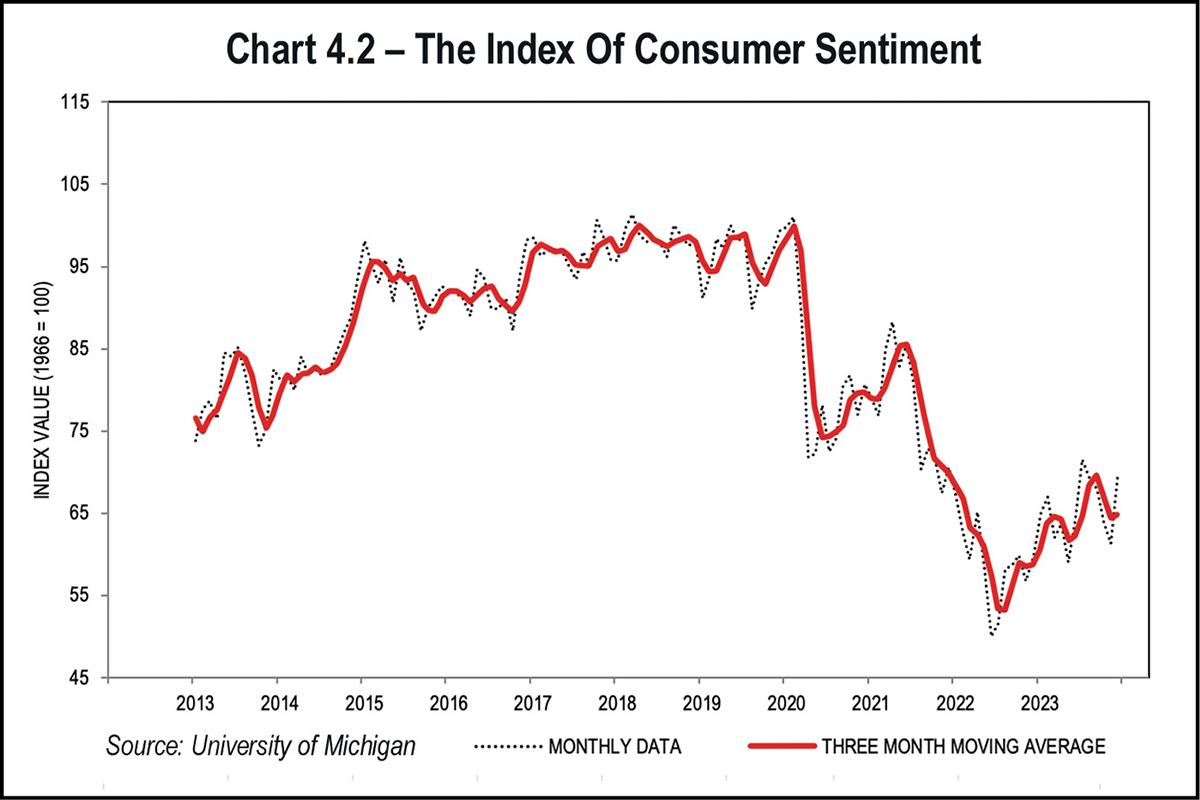

Current Trends in Consumer Prices and Inflation

Key statistics include:

- Average Annual Inflation Rate: The average annual inflation rate in the U.S. over the past decade has been around 2%, which is close to the Federal Reserve's target inflation rate of 2%.

- Consumer Price Index (CPI) Growth: The CPI has shown steady growth, reflecting the increase in consumer prices. However, the rate of growth has varied from year to year, influenced by factors such as energy prices, housing costs, and food prices.

- Sectoral Inflation Trends: Different sectors of the economy experience inflation at varying rates. For instance, healthcare costs have consistently risen faster than the overall inflation rate, while the prices of certain consumer goods, such as electronics, have decreased due to technological advancements and global competition.

Impact of Inflation on Consumers and the Economy

Inflation has a dual impact on the economy and consumers. On one hand, moderate inflation can indicate a growing economy with increasing demand for goods and services. On the other hand, high inflation can erode the purchasing power of consumers, particularly affecting those on fixed incomes or with savings that do not earn interest rates keeping pace with inflation.Strategies to manage the impact of inflation include:

- Diversified Investments: Investing in assets that historically perform well during periods of inflation, such as stocks or real estate, can help protect wealth.

- Index-linked Savings: Some savings accounts and bonds offer returns that are linked to inflation, ensuring that the purchasing power of savings is maintained.

- Budgeting and Financial Planning: Consumers can mitigate the effects of inflation by closely monitoring expenses, prioritizing needs over wants, and planning for future price increases.

For the most current data and detailed insights, visiting the official websites of the Bureau of Labor Statistics (BLS) and the Federal Reserve is recommended. These resources provide comprehensive information on consumer prices, inflation rates, and other economic indicators, helping to paint a clearer picture of the U.S. economy's performance and future outlook.